Just How To Avoid A Tax Obligation Audit In 2023

Additionally, they stop working to represent the 10% additional tax on very early distributions before age 59 1/2. If the tax preparer identifies an error she or he has actually made and calls it to the client's interest, convincing the customer to submit a modified return can assist ameliorate the trouble. To encourage the Premises liability coverage client to send a changed return, a professional should prepare the modified return, send it to the client, and strongly recommend the client documents it. In some cases, nevertheless, the blunder may involve an approach of audit, and the taxpayer has to request permission from the internal revenue service National Workplace to make an adjustment.

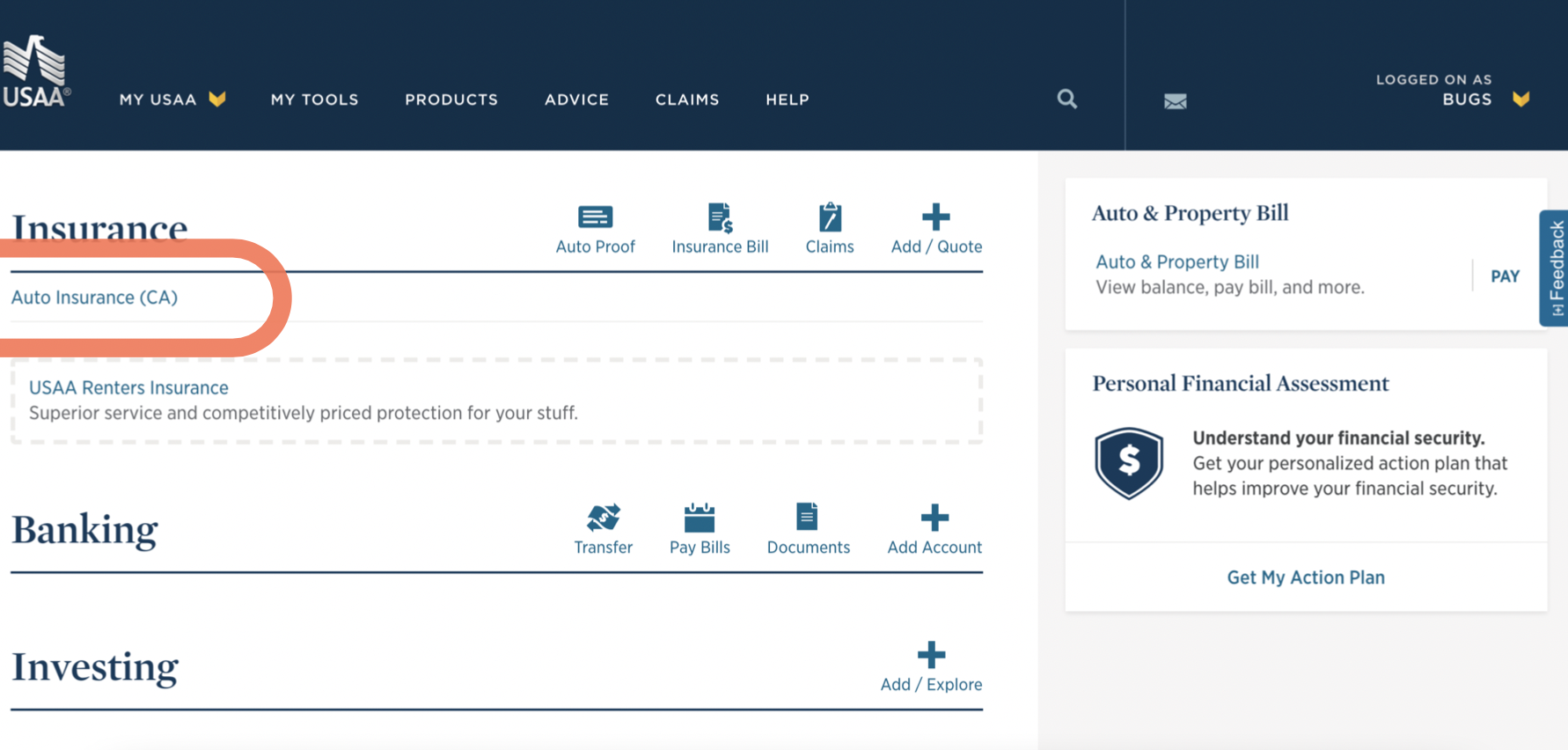

Failure To Include Required Documentation & Kinds

So let's have a look at just how you can reduce the possibilities of obtaining examined in 2023. If you need an extension for paying tax obligations, you can submit Form 4868 for single owners or Type 7004 for all various other type of business entities. Individuals with revenue from foreign sources may not recognize whether they should report it. Stopping working to divulge relevant international earnings to HMRC can result in significant effects, including fines and fines.

Typical Blunders When Filing Tax Obligations That Are Simple To Avoid

- Getting ready for an audit is an essential task that can considerably influence an organization's monetary wellness and compliance condition.The federal government uses a selection of credit reports, like the youngster tax obligation credit report, which permits moms and dads to declare up to $2,000 per certifying youngster.The procedure also includes a review of sales tax obligation payable against the sales tax obligation the firm really paid.Instances of start-up expenses are investigatory expenses such as surveys and travel costs for protecting suppliers, vendors, and clients.The penalties can be strong, and the Internal Revenue Service (IRS) does check.This will consist of a testimonial of your tax records, monetary records and any type of other papers or systems that associate with the monitoring of your service.

Conserve your hard made money by avoiding these typical accounting and tax obligation blunders a great deal of entrepreneur make. Ensuring all details are exact, giving called for details, and avoiding insurance claims for non-allowable costs are critical actions. Looking for assistance from reputable accounting professional company and submitting tax returns on schedule can dramatically reduce the possibilities of an HMRC investigation. If you are inaccurately reporting your revenue, you're sending an invite to the internal revenue service for an audit. The most effective technique is to accurately and truly upgrade all documents of your payments. This is an additional example of why employing an expert can be a lot more advantageous when it comes to Tax forms your business taxes and accounting.

Another variable that may assist limit expert exposure is whether the taxpayer added to the problem or presumed the danger of obligation. Mean the tax specialist asked the taxpayer to assess the prepared income tax return for its precision, and the taxpayer either did refrain so or did so negligently or carelessly. In such cases, regardless of the accounting professional's mistake or omission, the taxpayer had the last clear possibility to treat the trouble. Relying on the jurisdiction, such circumstances might discharge the tax specialist from obligation or reduce the quantity of responsibility to that percentage for which each event could be regarded accountable.

If you're applying a cash money only plan, you're making your business dealings look noticeable. As you know, HMRC will certainly explore significant claims of mismanaged taxes. One of the most typical people that triggered this chain of events are dissatisfied ex lover employees. These are simply the primary reasons why you might be at risk of a tax audit in 2023. Of course, if you have not lowered the possibilities of obtaining audited, then that time is significantly decreased. For 2023, the figures are $13,850 for solitary and married filing independently taxpayers, $20,800 for heads of households, and $27,700 for wedded declaring jointly taxpayers and surviving spouses.

Whether you're handling a small company or overseeing a huge company, the procedure can be elaborate and requiring. Efficient prep work not only enhances the audit but likewise highlights chances for business renovation. The write-up below will certainly describe essential methods for audit preparation and highlights typical mistakes to prevent.

How To Sign Up On The E-return System For On The Internet Tax Obligation Declaring In Bangladesh

Take control over your firm's tax techniques and with confidence handle international sales and use tax obligations, BARREL, and GST-- regardless of where worldwide you operate. Omitting these quantities generally result in the omission of revenue, which can result in imposing penalties and interest on any kind of additional quantity owed that had not been made up on the return. It's additionally vital to recognize if your sort of earnings calls for paying tax obligations more than annually.