How Much Tenants Insurance Coverage Should A Landlord Call For In 2023? We'll likewise maintain you both as much as date on whether their plan modifications, is terminated, or ends. Acquisition in less than a min, get your plan promptly, and conserve when you buy online. So one celebration has an insurance plan in position, the other half will be excluded outdoors if an accident must happen. An additional element of protection that differs between the two plans relates to what occurs if, for some reason, the home is no longer being inhabited. But your property manager's insurance policy is created to protect, well, your property manager, not you, the lessee. That indicates their insurance covers the physical building-- a ceiling that may leak, wall surfaces that may obtain harmed-- and all the stuff that they possess and you don't. The following step is to determine how much occupants insurance policy you'll require. You can change your extra living cost and liability protection as required. It's an excellent idea to buy adequate liability insurance coverage to cover what might be taken from you in a legal action. Occupants insurance policy usually covers windstorms, but doesn't usually compensate you for damages from floodings.

- If you set bench too expensive, some potential renters may be inhibited since they would certainly favor a location with little to no needs.If home insurance covers movable building that breaks unexpectedly and suddenly in any circumstance.Occupants insurance policy will certainly repay you the same amount whether your bike is taken from inside your house or while parked outside your favored coffee bar.

What You Require To Learn About Renters' Legal Rights

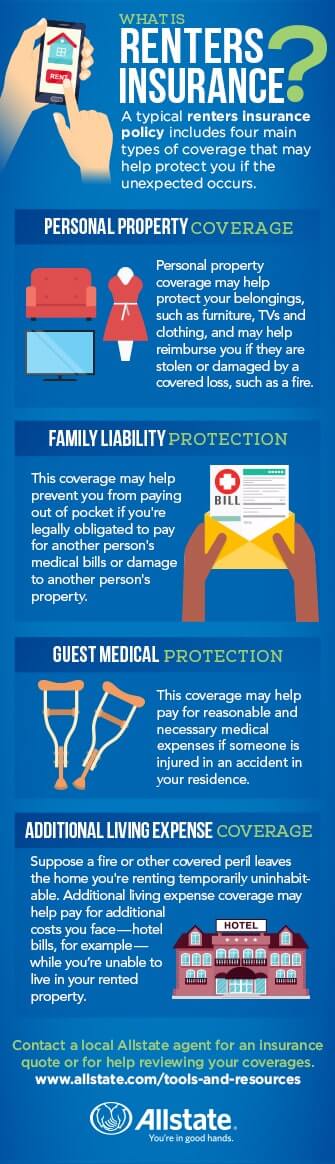

Needing renters insurance will comfort you both, recognizing their items are covered. Since house owners insurance policy is implied for owner-occupied homes, proprietors who rent their building to renters normally will not be able to safeguard their property with a common house owners insurance coverage. Every insurer uses something different, and the plans are going to vary based upon your specific company as well as where you live. To locate the most effective insurer for rental residential properties in your location, it is best to compare policies and ask various other landlords in the location what experiences they have had with the firms. The largest difference between mobile home occupants insurance and house owners insurance coverage is that occupants insurance policy gives no insurance coverage for the framework of the home. It's the property manager's duty to cover the structure with a different property manager insurance policy. Like a basic homeowners insurance plan, property owner insurance does not cover flood damage. You can purchase a policy via the National Flooding Insurance Coverage Program or a personal flood insurance company. Numerous property managers are beginning to require occupants insurance coverage since they desire their lessee's things to be safeguarded in instance of damage or burglary. This offers defense if someone is wounded while in your house or if you accidentally wound somebody. It pays any kind of court judgments and legal costs up to the plan limit. Your proprietor's insurance covers the framework and the premises, however not your personal belongings. A growing variety of landlords need tenants to buy their own renter's insurance coverage, and they'll anticipate to see evidence. There are lots of insurer that offer renters insurance policy online, so you can contrast their terms and the expense of premiums. Check the policy meticulously for protection restrictions and deductibles, yet bear in mind that they'll affect how much you need to pay in costs.City Of Helsinki

Based upon all of these elements, the insurance company will certainly supply a specific quantity of coverage at a details cost. As with all insurance, it is an excellent concept to shop around to make sure you are getting the best equilibrium of coverage and price via the plan you choose. Residential property insurance gives monetary compensation to the proprietor or occupant of a structure and its materials in case of damages or theft. Tenant's insurance policies don't cover losses caused by your very own negligence or deliberate acts. For instance, if you fall asleep with a lit cigarette and cause Commercial General Liability Insurance near me a fire, the policy probably will not cover the damage.Rent Guarantee Insurance for Landlords UK - Just Landlords

Rent Guarantee Insurance for Landlords UK.

Posted: Thu, 11 Aug 2022 14:51:43 GMT [source]